How To Work Out Furlough Pay For Variable Hours

Employers pay for any worked hours as normal and pay the tax and NICs due on both worked and unworked hours. You therefore use the maximum wage amount to calculate the minimum furlough pay.

An Employer S Guide To Furlough With The Coronavirus Job Retention Scheme Cjrs The Accountancy Partnership

How do I calculate the pay rate for staff with variable hours.

How to work out furlough pay for variable hours. In order to calculate the employers NIC and workplace pension contributions we knock the pence off the furlough pay rounding to 918 in this case. Finance expert Martin Lewis has called on bosses to pay zero hour contract workers affected by the coronavirus pandemic at least 80 percent of their wages through the Employee Furlough. An employee will be a variable hours worker where.

Number of usual hours 166 Subtract the 16 hours worked 166 16 150 furlough hours. Furlough hours are calculated as. Start with the wages payable to your employee in the last pay period ending on or before your employees reference date.

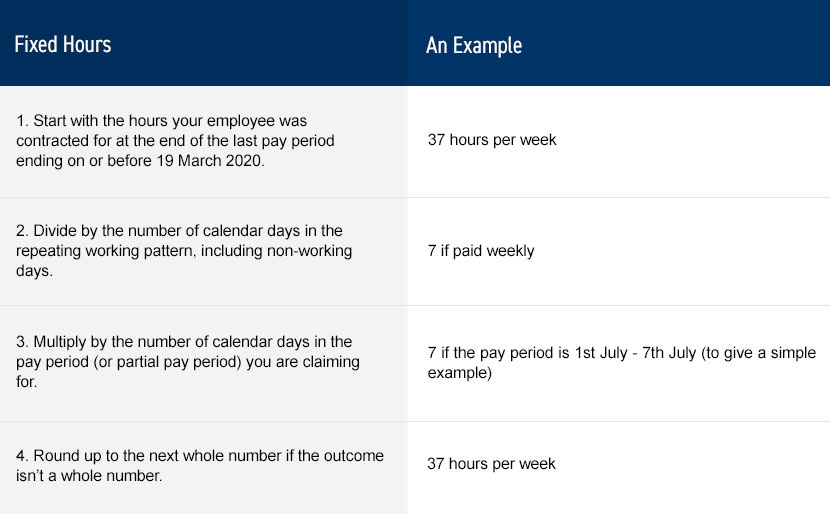

As the furlough pay is below the cap the employer can claim all of the furloughed pay under the CJRS. The number of furlough hours is calculated by taking the workers usual hours in the claim period and subtracting the number of hours actually worked in that period. Employers claim for a minimum period of seven consecutive calendar days and need to work out the hours worked and compare this to the usual hours an employee would work in that claim period.

Number of usual hours 166 Subtract the 16 hours worked 166 16 150 furlough hours. For hourly employees you can calculate this in one of two ways. For furloughed employees you continue to pay their salary as you did until 1 July 2020 under the CJRS requirements.

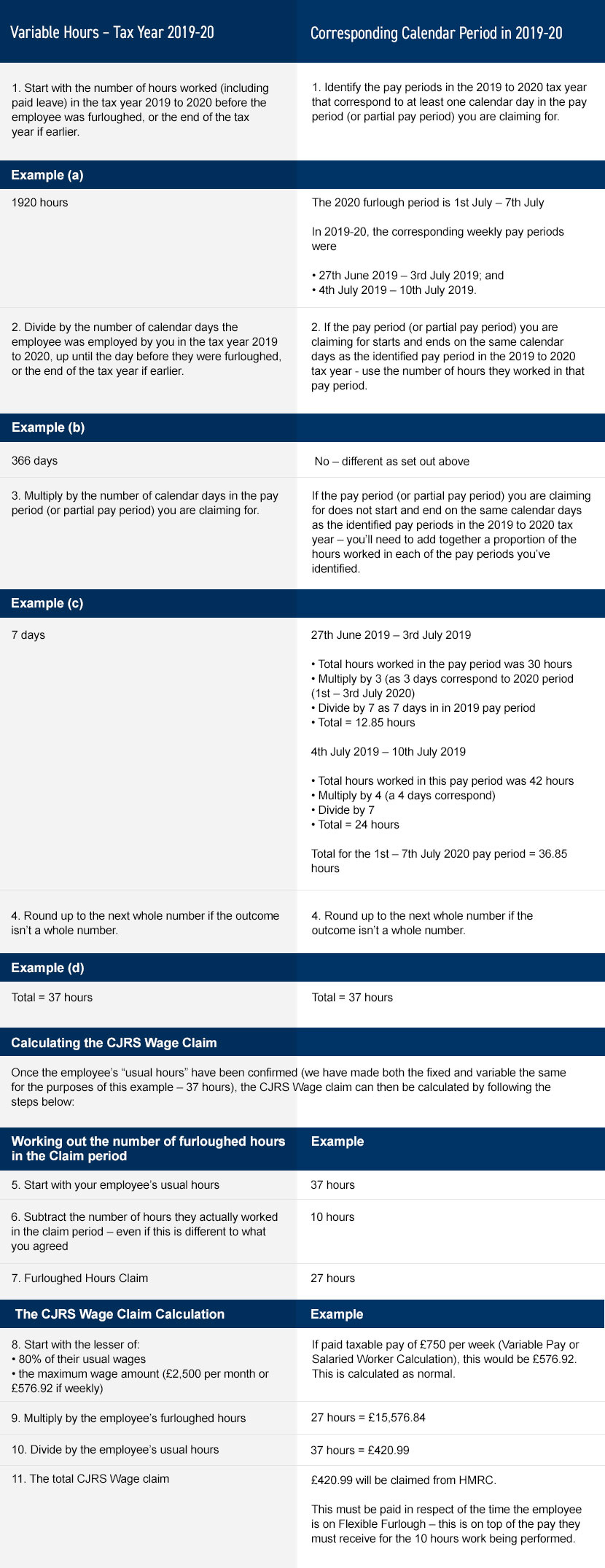

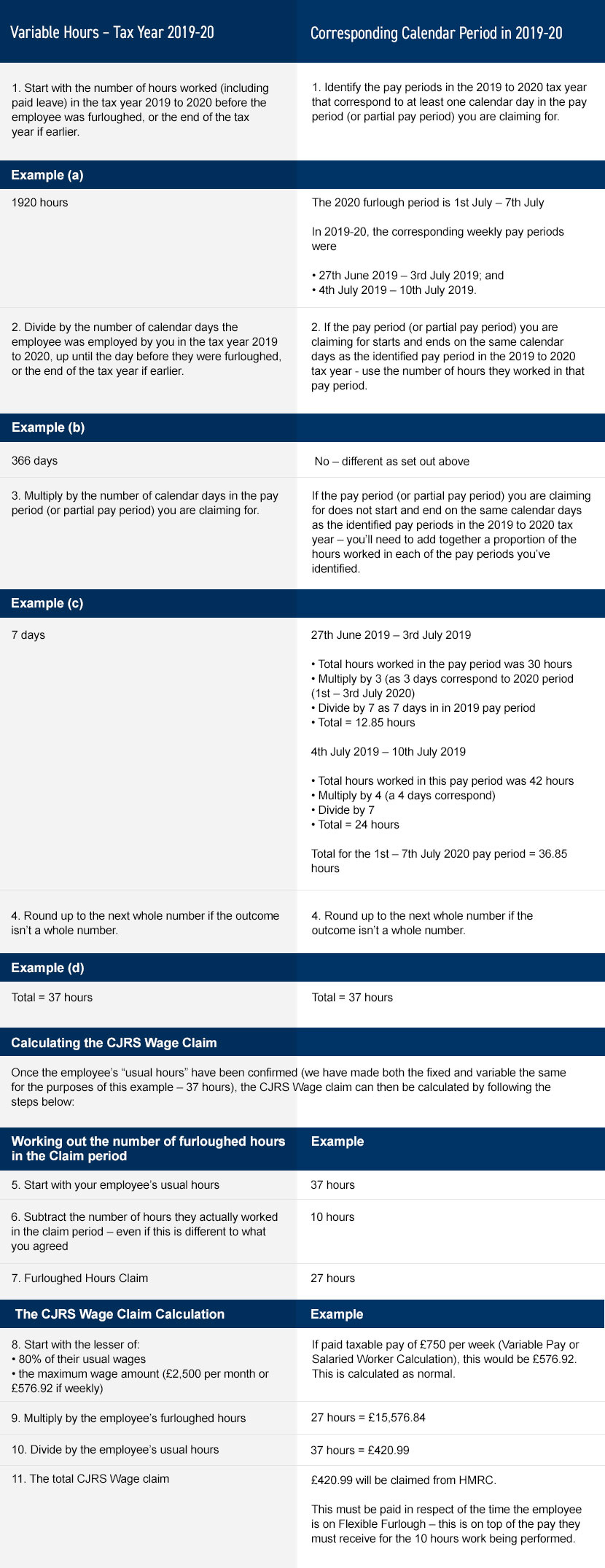

With flexible furloughing you again pay the employees salary but it comprises two components. Workers on flexible furlough must receive a proportionate amount based on the number of furlough hours. There are two different calculations you can use to work out your employees usual hours depending on whether they work fixed or variable hours.

Your employee is not contracted to a fixed number of hours or. Pay for week 1 962 x 25 hours 24038. To work out their weekly pay the employer adds up the 6 weeks of pay during furlough at their full normal pay of 300 a week.

To work out the furlough pay youll need to divide the number of furloughed hours by the total number of hours youre contracted to work multiplied by. Divide by the number of. To calculate the minimum furlough pay you multiply this figure by the employees furlough hours and divide by the employees usual hours.

732167 x 845 37038. Therefore in our example the calculation is 2500 multiplied by 120 divided by 184 or 163043. You should work out usual hours for employees who work variable hours if either your.

You should follow HMRCs guidance for calculating usual hours for employees who work variable hours if either. They are not contracted to a fixed number of hours. 35 hours in week 4.

Their pay depends on the number of hours they work. Pay for week 2 9. When they returned to work they worked 40 hours a week for 6 weeks receiving 400 a week.

However where variable hours employees are paid different rates for different hours worked or for different types of work you will need to pay holiday pay equivalent to the employees average pay in the previous 52 weeks. Chose the highest per employee then 80 and showed this on the payslip. A Fixed Hours Flexible Furlough Worker.

Looking at the earnings from the same month last year for example the earnings for March 2019. If neither of these apply they will be a Fixed Hours Flexible Furlough Worker. Working out a Flexible Furlough workers hours of work.

A Variable Hours Flexible Furlough Worker. Employee is not contracted to a fixed number of hours employees pay depends on the number of hours. Divide by 7 the number of days in the repeating.

Divide by the number of calendar days including non-working days. Then they add up the 6 weeks the employee worked at 400 a week. F Ltd then identifies the maximum wage amount and 80 of the employees usual wage to work out the furlough.

You fund the employees salary for the hours or days they work for you part-time or shift-based. They spent 6 weeks on furlough earning 80 pay. Its easy to calculate salaried employees its simply 80 of their before-tax salary prior to 28 February 2020.

Start with 37 hours the hours the employee was contracted for at the end of the last pay period ending on or before the employees reference date. The NIC threshold is apportioned to the furlough hours. 15 hours in week 5 only part of the week falls in the month Average hourly pay 1250 130 962.

Most employees get holiday pay at their basic daily or hourly rate.

Tips On Debt Payoff Helping People Become Debt Free Debt Free Living Reduce Debt Debt Free Debt Payoff

Flexible Furlough Guidance And Examples Mazars United Kingdom

Philips Sonicare Hx9690 07 Expertclean 7500 Bluetooth Rechargeable Electric Toothbrush Pink Brushing Teeth Sonicare Electricity

How To Calculate Your Employees Flexible Furlough Hours Mitrefinch

Flexible Furlough Guidance And Examples Mazars United Kingdom

Furlough Explained Answering Smes Burning Questions Mtb

Hmrc Update On Calculating Usual Hours For Furloughed Staff Cardens Accountants

Furloughed Employees Scheme Faqs Gmb

Https Elliswhittam Com Covid 19 Partnerships Wp Content Uploads 2020 06 Flexible Furlough Guidance Pdf

What Are Employers Required To Do About Breaks And Lunch At Work Red Bathroom Accessories Superhero Bathroom Small Bathroom Vanities

Claiming Furlough For Holiday Days

Job Retention Scheme Furlough Payments For Employees On Variable Pay Youtube

Flexible Furlough The Introduction Optimum

How Do I Calculate Furlough Pay For March And April Lovewell Blake

Claiming Furlough For Holiday Days

Flexible Furlough The Introduction Optimum

Examples Of Financial Goals By Age Groups Financial Goals Life Goals Quotes Personal Finance

Hmrc Confirms Usual Hours Calculation For Flexible Furlough Cowgills

Furlough Leave Uk Faqs Updates Hunter Global Business Solutions

Post a Comment for "How To Work Out Furlough Pay For Variable Hours"